9 years later: my return on investment for crowdfunded loans

Since 2009 I have been active in the field of crowdfunding. To learn about crowdfunding and to support great ideas, I have invested in a total of 568 projects since 2009. Out of this, 317 investments were in the form of a loan. Nine years later, I wondered what the net financial return of my loan portfolio was and set out to dive into the numbers. Because of the different types of loans (linear loans, annuities, bullets and loans with revenue based returns), but also costs and performance (platform and transaction costs, currency losses, late payments and (extra) grace periods with and without interest charges) it took me a few days to calculate my net return.

While most crowdfunding platforms are very transparent in sharing all data to give investors the possibility to calculate their actual return, some platforms make it very hard or almost impossible to do so. And some platforms presented an annual net return for my portfolio that didn’t match my actual returns.

My annualised return on investment

Let’s start with the result: my net annual return (minus all costs and losses) turns out to be negative at -1,2%.

My return per platform:

| Platform | Net annual return | # Loans |

|---|---|---|

| Bondora | 3,7% | 87 |

| CrossLend | -18,6% | 19 |

| CrowdAboutNow | 3,0% | 4 |

| DuurzaamInvesteren | 2,6% | 1 |

| Funding Circle | 10,6% | 1 |

| Geldvoorelkaar | 7,1% | 2 |

| Greencrowd | 4,0% | 1 |

| Kapitaal Op Maat | 4,8% | 1 |

| KIVA | -8,4% | 17 |

| Lendahand | 3,5% | 4 |

| Lendico | 5,0% | 2 |

| Mintos | -0,9% | 57 |

| MyC4 | -46,6% | 2 |

| Oneplanetcrowd | 4,7% | 1 |

| Symbid | 5,1% | 1 |

| Twino | 7,8% | 117 |

| Totals | -1,2% | 317 |

My 18 investments via Dutch crowdfunding platforms perform quite well and yield a net annual return of 4,7%. My portfolio doesn’t nearly cover enough loans to be able to draw any conclusions for the Dutch crowdfunding market or a specific platform. If you want to know more about the performance of the loan portfolios of Dutch crowdfunding platforms, head over to CrowdfundingCijfers.nl.

The status of my loans

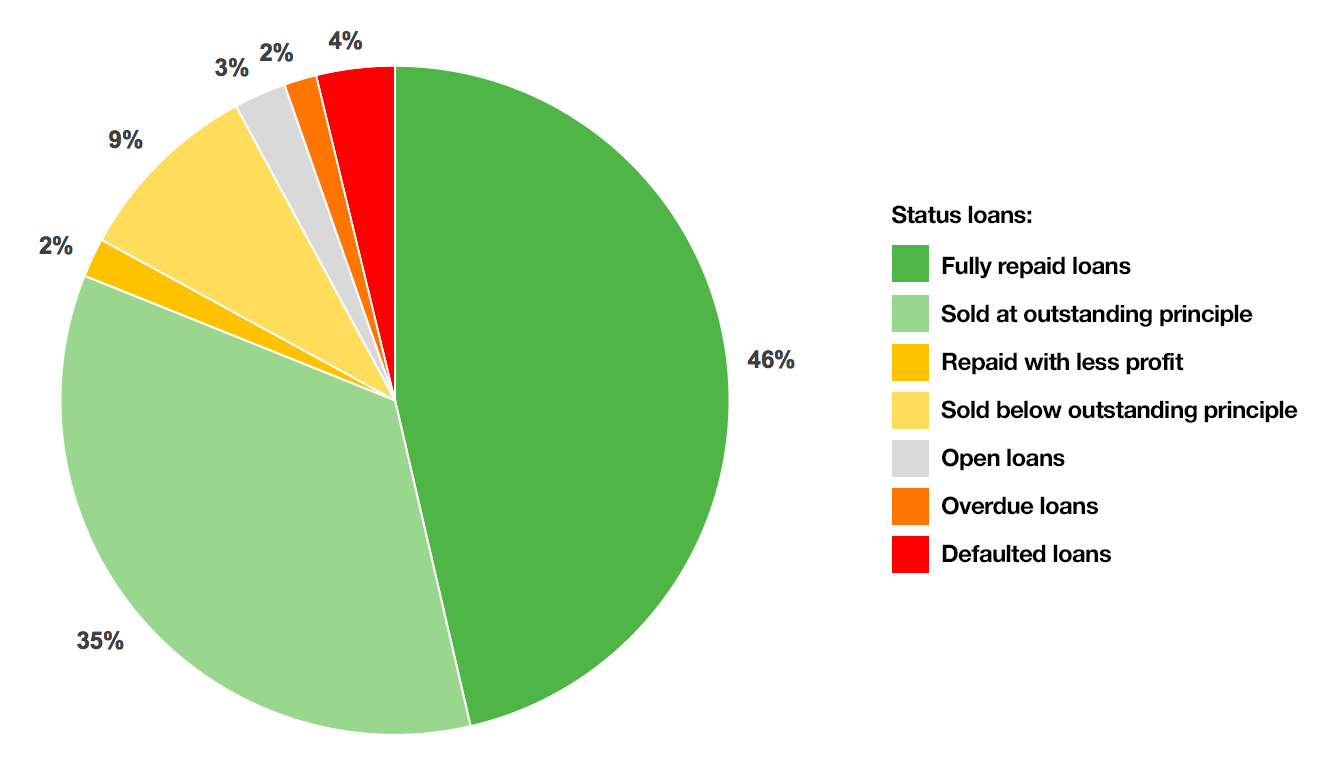

Of the 317 loans, a small number of 13 loans is still open. The status of the loans in my portfolio:

Because of currency losses and because some platforms don’t compensate investors for extra grace periods or late payments, some repaid loans yielded less profit than projected.

International platforms

The performance of my loan portfolio at international platforms is very diverse, as is my experience as an investor on those platforms:

Auto-invest, secondary markets and buy back guarantees

Bondora (Estonia), Mintos (Latvia) and Twino (Latvia) are Pan-European platforms. All three provide auto-invest and secondary market functionalities, resulting in a totally different investment experience from what I was used to on local Dutch platforms. After 1 to 2 years I sold all 3 portfolio’s and ended up with a very different return per platform. The reason for the high return of my Twino portfolio is a buy back gaurantee for any loans with late payments, keeping my portfolio ‘clean’. Mintos offers this functionality as well, but because it was harder to sell my portfolio at their secondary market, I ended up selling 11 loans at a loss. If I would have been more patient, this portfolio would have resulted in a positive return as well. At Bondora I ended up selling 81 loans, of which 18 overdue and defaulted loans at a price below the outstanding principle.

CrossLend: Over 50% of my loans defaulted

CrossLend (Germany) is a European marketplace for loans. Dutch ABN Amro recently joined CrossLend as shareholder. CrossLend does not offer retail investors auto-invest, secondary market or buy back functionalities, making it less attractive than the previously mentioned Bondora, Mintos and Twino. Over half of my loans defaulted at CrossLend, resulting in a double digit negative return on my loans.

Microfinance: Not always sharing in the profits

KIVA (USA) is an international platform for microfinance and for most loans it cooperates with microfinance institutions (MFI’s) as actual borrower. KIVA doesn’t offer any interest to investors, while some loans are exposed to currency risks or not backed by an MFI and can thus bear a high default risk. While most of my KIVA loans perform according to plan, 3 loans have resulted in a loss. Dutch platform Lendahand is also active in the field of microfinance and does offer investors a piece of the cake to cover for risks involved. This seems fairer towards investors. MyC4 (Denmark, liquidated in 2016) was the smaller brother of KIVA and operated as a marketplace where investors could bid on loans. The bids with the lowest interest rates would win the bid and fund the loan. Extremely high currency losses resulted in my double digit negative return.

Different flavours and motivations

Crowdfunding has many faces. There are two main types of lending-based crowdfunding:

Communityfunding

Communityfunding is a social phenomenon: an entrepreneur campaigns to attract investors who care about his business. Typically around half of the investors are already in the entrepreneur’s network. Some of the investors will become ambassadors of the company, providing more than money to make the company a success. Communityfunding campaigns take quite some effort and are usually funded in around a month.

Peer to peer lending

The other flavour is also known as ‘peer to peer lending’: a peer to peer lending platform has a pool of investors looking for alternative ways to invest (a part of) their savings and spread the risk over a large number of projects. Investors stay anonymous to the entrepreneur and in some cases the entrepreneur is also anonymous to investors. For companies, peer to peer lending can simply be a great alternative to a bank loan. Peer to peer loans are usually funded in a few days or much faster.

Meeting my expectations?

Obviously these two types of lending-based crowdfunding respond to totally different motivations. With communityfunding, investor motivations are more emotional and social. I personally enjoy this type of crowdfunding as a way to support entrepreneurs and their teams to start or grow their business and make a positive impact on the world around us.

With peer to peer lending, investor motivations are more rational. As an investor I’m quite disappointed by my experience with most of the peer to peer lending platforms, because of a lack of (easy accessible) loan performance data, incorrect loan performance data, an emphasis on marketing and funding loans instead of successfully managing loans, not always fairly (informing and) compensating investors for lost revenue because of late payments and extra grace periods, etc. To conclude, investors simply don’t seem to be the most important customer group for most peer to peer lending platforms.

There are however exceptions of platforms showing what’s possible. I am very content with my experience on some of the peer to peer lending platforms, like Twino and Lendahand. A few years ago I was positively surprised by the new functionalities on some European platforms: auto-investing, secondary markets and buy back guarantees. High returns and high liquidity seemed to work in theory, but didn’t always turn out that way in practice, as can be seen from the mixed results of my portfolio.

The role of financial authorities in protecting investors

Financial authorities are preparing new regulation related to the operation of crowdfunding platforms that might or does result in harm to investors (sources: AFM statement, FCA report). Until now most crowdfunding platforms in the Netherlands have shown to be reluctant in implementing advice from the Dutch AFM related to decreasing investor harm (source: AFM report).

It’s clear that investors are not a top priority to most platforms. Why? Because in day to day practice, peer to peer lending platforms experience how loans are funded in minutes or hours. There is simply no shortage of investors and retail investors are not organised to represent their interests. Secondly, the revenue models of most platforms have a strong emphasis on funding loans. There are only a few platforms with serious revenue streams from managing loans (and thus taking a default risk like investors). If platforms regard managing outstanding loans as costs and focus all efforts on the acquisition of more loans and funding these at all costs, it’s no wonder investors end up with negative returns and turn their back to some platforms or to crowdfunding entirely.

Making investors a top priority again

How can platforms make investors a top priority again? Drawing from my own experience as investor and the analysis of my own portfolio, I see the following opportunities for platforms that want to serve their investors better:

1. Better align platform and investors’ interests.

The majority of the revenue of crowdfunding platforms should come from successfully managing loans over time instead of providing new loans. In this case, the revenue of a platform and the interests of investors become more aligned. An extra benefit of spreading revenue over time is a more predictable future cash flow for the platform itself, potentially resulting in a lower risk of platform bankruptcy. In my view financial authorities should more actively motivate platforms to align their interests with investors. Not doing so, leaves a systemic flaw in the design of some platforms.

Interests should also be better aligned when platforms charge borrowers a fee for late payments or for restructuring a loan. In this case, investors should be duly compensated for their loss of revenue.

2. Provide investor friendly access to all loan performance data.

Platforms should provide investors access to all loan performance data per loan and the possibility to download this data per loan, for their complete portfolio and for the complete loanbook of the platform. Like me, most investors are spreading their risks over more crowdfunding platforms. Introducing a standard way of reporting would make comparing results much easier. And I think it doesn’t need any further explanation to state that all provided data should always be accurate and up to date.

3. New platform functionalities could especially make peer to peer lending more investor friendly, less risky and make investments more liquid.

All peer to peer lending platforms should innovate their platform to offer auto-invest, secondary market and buy back guarantee functionalities, making peer to peer lending a less time consuming effort. There are legislative hurdles, risks and challenges involved when taking these steps, but in my view implementing these functionalities will be the only way to stay competitive as a peer to peer lending platform for retail investors a few years from now.

To realise the full potential of crowdfunding, platforms should accommodate the interests of retail investors who don’t have the time, knowledge or power of professional and institutional investors. On the short term it seems all too easy to put less emphasis on investor needs. But on the long term this will hurt platforms. Platforms that are lagging behind in implementing the 3 opportunities defined have already seen their public reputation and their reputation amongst finance advisors drop, resulting in a decreasing number of deals. What comes around, goes around.

The role of investors: pool information and create a more united voice

Next to the role of financial authorities and platforms, investors should share their experiences in public, to shape and speed up these developments. At the Dutch FOK forum, (peer to peer lending) investors are actively sharing their experiences with each other. Could this be taken to the next level, by pooling portfolio data and creating a united voice in the market?

I am positive about the future of crowdfunding, communityfunding and peer to peer lending. I will continue to invest in great companies and I’m looking forward to a more grown-up crowdfunding market with winning platforms that make investors a top priority again.